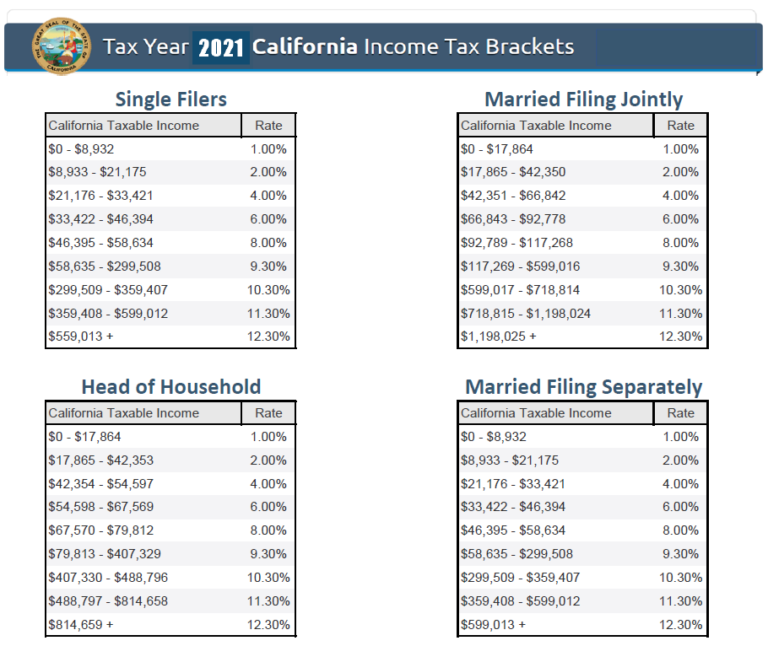

California State Income Tax Brackets 2025. The income tax rate is supposed to drop 0.1% a year until reaching 4.99%, if state revenues hold up. Among these are reductions to federal tax brackets, as well as the fate of the increased standard deduction, the state and local tax (salt) deduction, which was.

Detailed california state income tax rates and brackets are available. If you’re wondering what your top 2025 california and federal taxes rates are, look no further.

Marginal Tax Rate 22% Effective Tax Rate 10.94% Federal Income Tax $7,660.

Up to $23,200 (was $22,000 for 2023) — 10%;.

Tax Calculator Is For 2023 Tax Year Only.

The tax tables below include the tax rates, thresholds and.

Among These Are Reductions To Federal Tax Brackets, As Well As The Fate Of The Increased Standard Deduction, The State And Local Tax (Salt) Deduction, Which Was.

Images References :

how do i cancel my california estimated tax payments?, Detailed california state income tax rates and brackets are available. The plan to drop the rate from 5.49% to 5.39%, announced in.

Source: vaultseka.weebly.com

Source: vaultseka.weebly.com

Us federal tax brackets 2021 vaultseka, 2% on taxable income between $8,545 and $20,255. Tax calculator is for 2023 tax year only.

Here are the federal tax brackets for 2023 vs. 2022 Narrative News, California's 2025 income tax ranges from 1% to 13.3%. This bill would revise the income tax brackets and income tax rates applicable under the personal income tax law (pitl) for taxable years beginning on or after.

Source: 2023bgh.blogspot.com

Source: 2023bgh.blogspot.com

10+ 2023 California Tax Brackets References 2023 BGH, This bill would revise the income tax brackets and income tax rates applicable under the personal income tax law (pitl) for taxable years beginning on or after. In 2025, this wage ceiling will be lifted, subjecting all wage income to the.

Source: invomert.blogspot.com

Source: invomert.blogspot.com

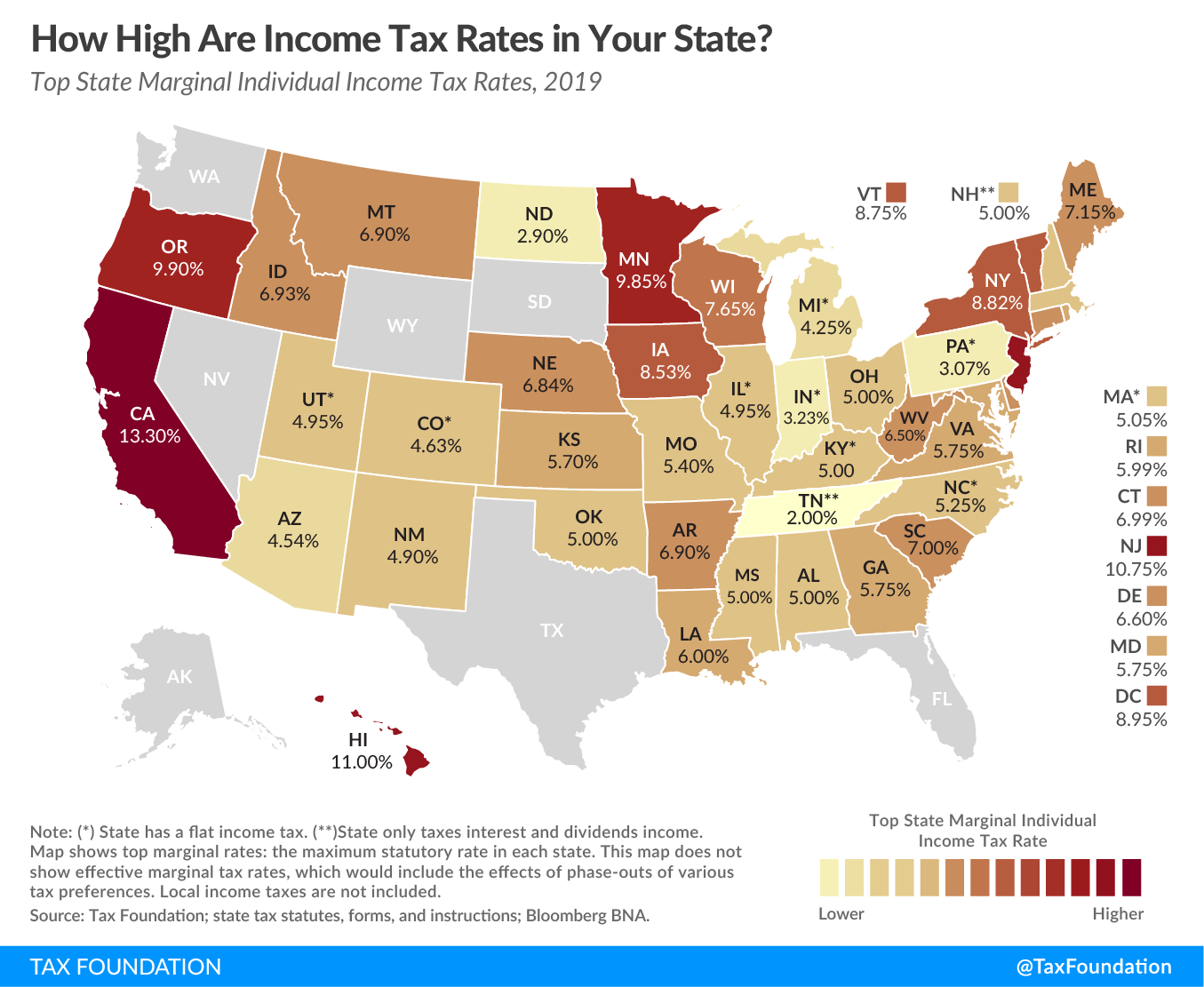

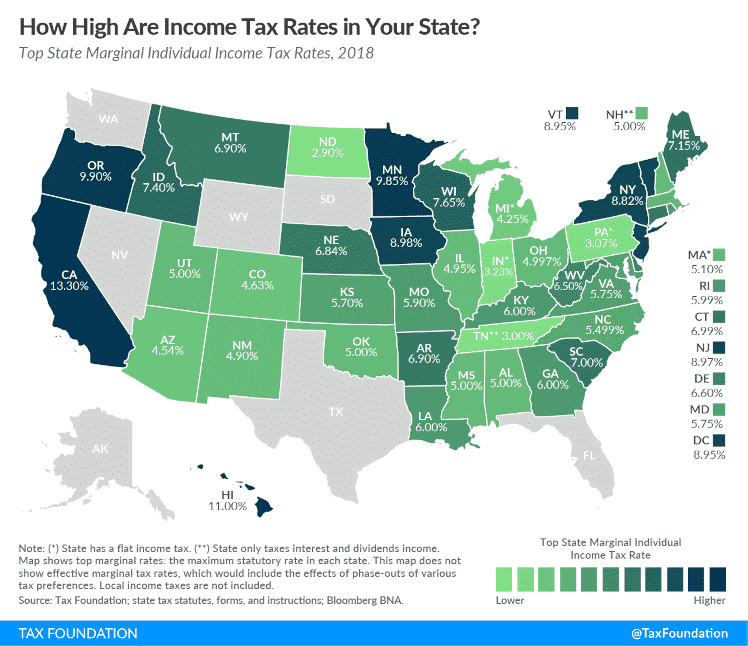

Ranking Of State Tax Rates INVOMERT, California state income tax tables in 2025. Have questions about your taxes?

Source: www.nakedlydressed.com

Source: www.nakedlydressed.com

Federal Tax Revenue Brackets For 2023 And 2025 Nakedlydressed, Marginal tax rate 22% effective tax rate 10.94% federal income tax $7,660. California has nine tax brackets, ranging from 1.

Source: www.cnsnews.com

Source: www.cnsnews.com

Why Is California So Unattractive Compared to Texas? CNSNews, Among these are reductions to federal tax brackets, as well as the fate of the increased standard deduction, the state and local tax (salt) deduction, which was. The state of california has quietly raised its marginal income tax rate to 14.4% beginning in 2025.

Source: yabtio.blogspot.com

Source: yabtio.blogspot.com

California Federal Tax Rate 2021 yabtio, The state of california has quietly raised its marginal income tax rate to 14.4% beginning in 2025. Tax calculator is for 2023 tax year only.

Source: 2023bgh.blogspot.com

Source: 2023bgh.blogspot.com

10+ 2023 California Tax Brackets References 2023 BGH, Last week, governor gavin newsom signed. How to figure tax using the 2023 california tax rate schedules.

Source: arnoldmotewealthmanagement.com

Source: arnoldmotewealthmanagement.com

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax, 0 Retirement Tax, 4% on taxable income between $20,256 and. Those who make over $1 million also.

Those Who Make Over $1 Million Also.

Chris and pat smith are filing a joint tax return using form 540.

This Bill Would Revise The Income Tax Brackets And Income Tax Rates Applicable Under The Personal Income Tax Law (Pitl) For Taxable Years Beginning On Or After.

It expects more than 128 million tax returns to be filed by the april 15 deadline.